|

|

[Tempatan]

Sektor Hartanah Dah Dok Sejuk, Tunggu Apa Lagi Turunkan Harga Kalau Nak Survive

[Copy link]

|

|

|

i, umah kat kelantan dah beli, umah kat kyhell dah beli

keta rx8 sebijik, VW sebijik, superbike sebijik

feel like shit bro !!

keke |

|

|

|

|

|

|

|

|

|

|

|

bkn takat rumah..rege tanah pun dh naik...mana nk carik tanah rege murah2 skrg..tanah kubur je free...tanah leasehold pun mahal... |

|

|

|

|

|

|

|

|

|

|

|

faraway1 posted on 14-9-2014 01:26 AM

sejuta ke atas aje dorang boleh beli....

jangan begitu sis

cina ni, tak semua yg buat duit cara yg legal ..kita jgn tengok satu benda tu dari aspek duit banyak duit sket

berlaku di taiping ...cina abis belajar, spm kantoi ...pi oversea ...cakap nak bukak bisnes ayam ...WTH ???

kemudian selang beberapa tahun balik Mesia, duit berkepak2 dalam akaun,keta conti bagai,umah banglo bagai

last2 kantoi ...pi oversea sebab uruskan dadah geng2 senior cina mesia di seluruh pelusuk mesia

Mesia ni hab dadah antarabangsa sis ...tokey besar cina ...yg bahlol dungu jadi keladai awek melayu bagai

see ??

kemudian utk nampak legal, bukak bisnes kat Mesia ...bukak kedai baiki motor, baiki keta,bukak kedai aksesori audio..padahal tokey haram tak tau lansung pasal benda2 tu cuma cari budak2 cina lain yg ada kemahiran yg penah keja dgn kedai2 cina lain, ajak masuk keja

nampak la legal

and yes ...hotel paling berprestij di Taiping, Flemington Hotel, polis dah letih nak rush pasal dadah n senjata api

tokey Cina .... bukan nak racist tapi benda ni mmg camni berlaku

Black Money, Bad Money .... abis punah anak2 melayu isap dadah, anak2 cina jadi taukey token

|

|

|

|

|

|

|

|

|

|

|

|

kerunai posted on 14-9-2014 07:29 PM

jangan begitu sis

cina ni, tak semua yg buat duit cara yg legal ..kita jgn tengok satu benda tu ...

blamekan cina semata melayu tak menjadi tak boleh jugak..

pendek akal sangat ke kita nj sampai di tanah sendiri pun merempat,

patutnya kalau vina pandai guna duit haram membina diri di Malaysia,

melayu guna pendidikan untuk setanding dan mampu beli rumah memahal.. Malangnya tidak.. So

merempat di negara sendiri sambil blame orang lain..

tapi tu lah... harta haram orang kafir berkat pulak sampai boleh kaya....

|

|

|

|

|

|

|

|

|

|

|

|

batu kikir posted on 14-9-2014 01:05 PM

Ada orang yang konon2 berasa dah jadi half millionaire mahupon millionaire.

Dulu beli rumah 100-200 ...

Apabila kerajaan menetapkan limit harga untuk pembeli luar dari RM500K kepada 1 juta, lagi developers dan penjual tekan harga agar hartanah jadi sejuta lebih kesemuanya.

Dah jelas target depa adalah pembeli luar. Depa memang tak pernah nak bercadang jual pada pembeli2 M'sia sendiri kerana depa pun sedar harga2 yang depa letak tu dah di luar kemampuan penduduk tempatan.

Kerajaan perlu hapuskan terus kuasa pembeli luar ni dengan introduce pepe je lah measures yang boleh menghapuskan kuasa beli depa dalam sektor hartanah negara , sebab depa yang menyebabkan harga hartanah melambung tak terhingga ....

foreigners boleh sewa lah kalau nak betul2 tinggal di M'sia , yang dok beli tu pun cuma biarkan kosong je bukan boleh menyumbang pada ekonomi negeri pun kalau duduknya idak .

|

|

|

|

|

|

|

|

|

|

|

|

Acong posted on 14-9-2014 05:54 AM

apasal masa rega RM350k tu ko tak beli?

bukan semua yg terjual pun bro...skang ni rega turun balik tapi xpasti berapa ... yg ramai beli masa early bird ...yg rega dah 450 ke atas, hanya tokey2 cina 2,3 kerat yg beli tu pun rega 450 ...lebih takde yg beli ...oh well

|

|

|

|

|

|

|

|

|

|

|

|

Wei.. aku yg selama ni bayar duit rumah bulan2 balance gaji tggl cukup2 makan je nak hidup...

baru2 ni BLR naik, bayaran rumah bulan2 pun naik.. naik bukan sikit, beratus jugak.. makin sikit duit makan aku..

bukan rumah landed pun.. apartment kecik je.. merana jiwa raga..  |

|

|

|

|

|

|

|

|

|

|

|

blastoff posted on 15-9-2014 08:35 AM

Apabila kerajaan menetapkan limit harga untuk pembeli luar dari RM500K kepada 1 juta, lagi develop ...

Oooo target pembeli Luar ek.. No wonder org dr Jakarta n singapore berebut beli kondo kat sini.. 500k murah katenyer.. Beli 2-3 bijik tros Last edited by poison_paradise on 15-9-2014 02:10 PM

|

|

|

|

|

|

|

|

|

|

|

|

blastoff posted on 15-9-2014 07:57 AM

Amerika dan Europe asyik cetak duit 24/7 , kemudian lambakkannya di pasaran untuk di miliki oleh seg ...

Beli tanah buat rumah sendiri, atau tanah yang ada jgn dijual.. ? Tp kalu kat kl aku xtaulah.

|

|

|

|

|

|

|

|

|

|

|

|

Aku ingat setiap yg kita mahu tak semua kita akan dapat,nakkan harta mungkin anak anak terabai,tak capai cita cita ke U...nakkan anak cemerlang,pengorbanan harta la pulak...

Jadi macam Tuan Blastoff kata keseimbangan tu penting... |

|

|

|

|

|

|

|

|

|

|

|

poison_paradise posted on 15-9-2014 02:07 PM

Oooo target pembeli Luar ek.. No wonder org dr Jakarta n singapore berebut beli kondo kat sini.. ...

Mulai 1 mac tahun ni hartanah di KL yang berharga sejuta dan ke atas saja boleh di beli oleh pembeli luar , sebelum tarikh tu harga minima adalah RM 500K.

Tahun lepas waktu harga minima RM500K masih berkuatkuasa , memang banyak lah condo dan rumah yang di beli pembeli luar, tup tup kerajaan naikkan jadi RM1 juta tahun ni maka terbantutlah segala aktiviti pembelian oleh foreigners tu semua.

Tu yang sekarang ni developers dok menggelupur banyak property tak laku . Dah tahun2 sebelum ni developers usaha berulangkali naikkan harga rumah nonstop untuk sampai tahap RM500K , dan tahun2 lepas dok laku sakan segala property baru tu semua di beli foreigners .

Tup tup kerajaan naikkan plak jadi harga minima sejuta..... penat developers dok mengejar harga minima tu kemudian elok dah capai tuptup naik lagi so nak kena kejar semula . Macam main kejar lawan passing baton

Sekarang nih developers perlu terus secara konsisten menaikkan harga rumah hingga sampai ke harga minima sejuta untuk membolehkan ramai pembeli luar layak beli condo dan rumah tu semula .

Sebab tu lah developers terus naikkan harga from time to time sesambil mulut depa membebel kata tak laku kos meningkat bla bla bla , sebab target depa adalah agar kenaikan mencecah hingga sejuta kemudian depa boleh dengan senang jual pada foreigners .

Depa tak peduli rakyat tempatan nak merempat ke hapa. Yang penting depa kaut untung berganda-ganda .

Last edited by blastoff on 15-9-2014 03:58 PM

|

|

|

|

|

|

|

|

|

|

|

|

mizahanan posted on 15-9-2014 02:18 PM

Beli tanah buat rumah sendiri, atau tanah yang ada jgn dijual.. ? Tp kalu kat kl aku xtaulah.

Zaman dulu kala penjajahan tanah adalah cara peperangan, makna nya guna senjata dan kekerasan untuk memiliki tanah negara lain . Natijahnya Rakyat tempatan merempat .

Zaman lani penjajahan tanah adalah cara pembelian tapi bayaran guna wang yang dicetak secara penyelewengan , makna nya guna wang haram untuk membeli secara halal bagi tujuan memiliki tanah negara lain , natijahnya sama aje rakyat tempatan merempat .

Amerika dan Europe bertindak cetak duit sesuka hati tanpa had , lalu duit2 tu di guna oleh orang2 tertentu untuk membeli hartanah di seluruh dunia .... maknanya depa jajah tanah negara lain guna wang yang dicetak secara penyelewengan.

Jadi depa beli seberapa banyak hartanah yang depa suka guna duit yang boleh di perolehi tanpa hadlimit tu ... Bayangkan lah seluruh negara depa boleh beli tanah dan rumah sebanyak mana yang depa inginkan , kemudian apa jadi pada penduduk tempatan ?

Merempat di negara sendiri lah jawabnya tak mampu berumah semua.... one day orang tempatan nak kena sewa plak pe dari orang luar , lagi teruk kalau gitu .

Memandangkan kerajaan dah perkenalkan hadlimit harga yang boleh di beli orang luar, maka developers naikkan harga setinggi-tinggi nya hingga sampai limit yang di benarkan oleh kerajaan tu lah , agar hartanah dapat di beli oleh puak2 seleweng duit nih.

Kat negara lain yang tarak had limit harga macam M'sia buat tu, maka memang akan naik lagi dan lagi lah harga rumah , sebab dah terlampau di beli oleh puak2 seleweng duit nih dek kerana demand yang tinggi wujud maka harga pun naik tak berhenti2 la , tapi bukan kerana di beli rakyat tempatanpun .

Tapi yang pastinya jadi mangsa adalah rakyat tempatan , yang tak mampu nak kejar kenaikan harga rumah kerana pendapatan depa tak setara dengan kenaikan harga tu semua.

Last edited by blastoff on 15-9-2014 04:27 PM

|

|

|

|

|

|

|

|

|

|

|

|

Psychedelia posted on 15-9-2014 08:51 AM

Wei.. aku yg selama ni bayar duit rumah bulan2 balance gaji tggl cukup2 makan je nak hidup...

baru2 ...

Orang-orang yang berada dalam situasi kau ni berlambak2 di seluruh M'sia, beli rumah kecik tapi kena amek pinjaman tinggi ya amat walau pendapatan cukup2 makan je..... untuk berlakunya krisis mortgage macam kat US tu memang senang sangat, jadi aje kenaikan kos mendadak certain mende melebihi apa yang korang boleh cover nescaya default habih la payment di buatnya .

|

|

|

|

|

|

|

|

|

|

|

|

Cuba bayangkan apabila kerajaan di sebuah negara yang di bebani hutang yang banyak bertindak cetak duit sebanyak2 nya untuk bayar hutangnya dan beli berbagai2 benda dari seluruh dunia , lalu menyebabkan demand yang tinggi wujud di pasaran dunia yang melonjakkan harga segala barang jadi tinggi tak mau-mau ....

Tapi rakyat di kesemua negara2 tu tak miliki duit sebanyak si pencetak wang nih , so rakyat pastinya terperangkap dalam inflation yang tinggi lah jawabnya , kerana gaji2 depa yang rata-rata di dasarkan pada produktiviti tu takkan dapat mengejar kenaikan harga2 barang yang melonjak sakan kerana pembelian hasil dari cetakan wang sesuka hati kerajaan tu .

--------------------------------

Printing more money to save a failed system

Thanong Khanthong

thanong@nationgroup.com September 21, 2012 1:00 am

Monetarists - not kings or queens, or presidents or prime ministers - rule the world, for the worse rather than for the better. It is not known who has given Mario Draghi, the president of the European Central Bank, a license to undertake "outright monetary transactions", the European version of perpetual money printing. Draghi will be committed to an "unlimited" bond buying programme to save the euro and prop up the sovereign debts. This unlimited bond buying programme will be accompanied by clear steps to create the "Federation of Nation States", or the "United States of Europe".

Draghi is a pure monetarist, one who believes that money printing can save a drowning economy.

Across the Atlantic, the US Federal Reserve has also announced a third round of money printing, known officially as quantitative easing (QE3). Ben Bernanke, the Fed chairman, says the Fed will be targeting the weak labour market by purchasing mortgage-backed securities to the tune of US$40 billion a month to stimulate the economy. Another $45 billion will be spent per month to purchase long-term US Treasuries, to hold down the long-term interest rates, which are already at an abnormally low level.

The US Fed has a strange dual mandate - managing price stability and ensuring full employment. It is a bizarre theory to hold that monetary policy, or money printing in plain terms, can bring about full employment. However, the Fed is now ignoring price stability, in spite of rising food and fuel prices, and is focusing on adding fresh liquidity and holding the rates down further to stimulate the labour market.

Bernanke also belongs to the monetarist camp, which equates money printing with economic growth and employment. Most people now call QE3 "QE infinity", since the Fed plans to intervene in the financial system indefinitely until the labour market improves. Since the previous two rounds of QE, which can only buy time, have failed to improve economic conditions, how can QE infinity turn the economy around?

Dr Paul Krugman, a Nobel prize winner in economics, has infamously called for massive stimulus - both fiscal and monetary - to reflate the Western economies, even though they are saddled with a mountain of debt that will never be paid off.

In Asia, the Bank of Japan has long been manufacturing money out of thin air. It has just announced an eighth round of money printing to prop up the ailing Japanese economy. The Bank of Japan is to purchase 10 trillion yen of bonds to add further liquidity into the financial system. Now it has 80 trillion yen of bonds in its portfolio, equivalent to 20 per cent of Japan's gross domestic product.

Bank of Japan Governor Masaaki Shirakawa said on Wednesday - against this wish - that Japan is now maintaining the easiest monetary conditions in the developed world. "I do not think that you could argue that the Bank of Japan is less bold than the Fed," he said.

The Japanese economic bubble went bust in 1990 and the economy has not recovered since, in spite of heavy-handed government intervention through both fiscal and monetary means. Fiscal intervention, including the cost of maintaining the country's welfare system, now brings the Japanese debt up to $14 trillion or 230 per cent of GDP. Aggressive bond buying by the Bank of Japan has driven interest rates down to the 0 per cent mark - the first central bank in the rich world to do so. The monetarists also rule over Japan.

The problem with the Keynesians and monetarists is that they don't allow the economy to go through the normal, albeit painful, process of restructuring and debt reduction. The bubbles built up before the busts in Japan, Europe and the United States. Instead of undertaking a restructuring, the US Fed, the European Central Bank and the Bank of Japan have chosen a convenient path of money printing.

We all know that money printing sows the seeds of hyperinflation. It will destroy the global economy. It seems that since the European Union, the US and Japan have all gone bankrupt, they want the rest of us to go down the drain with them.

It is time for a new regional financial architecture to be created, to move away from the global dominance of the Fed, the ECB and the Bank of Japan, which exist to prop up the banks' balance sheets rather than helping the real economy to recover.

http://www.nationmultimedia.com/ ... ystem-30190786.html

Last edited by blastoff on 15-9-2014 05:16 PM

|

|

|

|

|

|

|

|

|

|

|

|

kerunai posted on 15-9-2014 08:17 AM

i, umah kat kelantan dah beli, umah kat kyhell dah beli

keta rx8 sebijik, VW sebijik, superbike s ...

aku ndak injam duit hang 4 jota ....

ropiah

|

|

|

|

|

|

|

|

|

|

|

|

Pernah terfikir camne kerajaan amerika boleh ada duit yang banyak untuk berbelanja nonstop beli segala maknenek peralatan perang lah, malah menguasai ekonomi dunia dengan pembelian segala macam mende yang mahal2 belaka.

Walaupun negara tu di bebani hutang yang teruk, tapi tak pernah slow down berbelanja pun kerajaan amerika nih , so mana dapat duit tu ? Of course la cetak sendiri nonstop yang merupakan sumber duit tanpa henti

Last edited by blastoff on 15-9-2014 05:26 PM

|

|

|

|

|

|

|

|

|

|

|

|

|

Of course kita buleh berfikir begitu, itu sbb ada cetakan wang palsu. |

|

|

|

|

|

|

|

|

|

|

|

Kadar inflasi memang akan naik lagi dan lagi .... kesan dari pembelian tanpa henti yang di buat oleh negara2 kuasa besar dunia bagi mengganggu keseimbangan harga agar ekonomi negara2 lain menjunam dan rakyat jadi miskin di negara sendiri .

Itu lah peperangan ekonomi yang sedang berlaku di seluruh dunia. Kita kat M'sia ni pun tak terkecuali , satu benda yakni hartanah yang merupakan investment terbesar rakyat yang depa kuasai dah laa untuk mengkacau bilaukan harga , majoriti rakyat jadi miskin di buatnya  Middle class la ni dah masuk kategori cukup2 makan je sebenarnya . Middle class la ni dah masuk kategori cukup2 makan je sebenarnya .

----------------------------

What does it mean to be middle class in Malaysia?

The Malay Mail Online – 11 hours ago The Malay Mail Online – 11 hours ago

KUALA LUMPUR, Sept 15 — As the cost of living continues to rise and salaries struggle to catch up, Malaysia’s middle class may be shrinking with some hanging on by a thread and others even falling off into poverty. Although there has been a steady but painfully small incremental rise in household income in Malaysia, economists and academics say the term “middle class” does not have the same meaning it had more than 10 years ago.

With salaries unable to match inflation, being middle class no longer means as comfortable a living as compared to 20 years ago.

While disposable income or savings is a good indicator of how many people “live comfortably” or fall within the middle class category, both Bank Negara and the Statistics Department said they do not keep track of such data.

Salaries and household income

Out of almost 7.8 million working Malaysians, the median salary for 2012 and 2011 was stagnant at RM1,500. In 2010, it was slightly less at RM1,480.

The median household income was RM3,626.

In comparison, median household income for the top 20 per cent is at RM9,796, the middle 40 per cent RM4,372 and the bottom 40 per cent is at RM1,852.

Over the weekend, Minister in the Prime Minister’s Department Datuk Seri Abdul Wahid Omar was quoted by state news agency Bernama as saying the preliminary report on the latest Household Income Survey showed the median stood at RM4,258, this year.

Who are the middle class?

Institute for Democracy and Economic Affairs chief executive officer Wan Saiful Wan Jan said the middle class should consist of the middle 40 per cent with monthly incomes of at least RM3,000 all the way up to the top 20 per cent of incomes, which has a median of about RM9,800 for 2012. Based on the household income data for 2012, less than 51.8 per cent of Malaysian households belong in that category.

But does a household income of RM3,000 a month really put a family of four among the middle class?

Universiti Sains Malaysia (USM) associate professor in economics Dr Lean Hooi Hooi said the middle class should be defined as individuals or households with RM4,000 to RM20,000 of disposable income every month.

“I think over the past five years, the inflation rate has been very high even though officially it was only at two to three per cent. We all feel the pain.

“Just go to the hawkers… for noodles or rice, prices go up 10 per cent every year,” she said in a phone interview recently.

Sunway University Economics and Management Department head Dr Wong Koi Nyen, on the other hand, defined the middle class as semi-professionals and young professionals, based on their earning range per month of about RM5,000 and RM10,000 for families.

According to figures from the Statistics Department, RM5,000 is actually more than three times the median salary, and the household income of RM10,000 is almost three times the median household income.

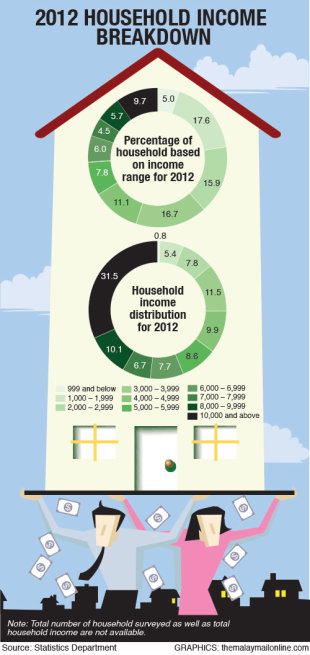

The 9.7 per cent of households in the highest income bracket of RM10,000 per month and above made up 31.5 per cent of overall household income recorded in the country.

In comparison, 17.6 per cent of household incomes, earning between RM1,000 and RM1,999, contributed to only 5.4 per cent of total household income, even though they formed the single largest group.

For the semi-professionals and young professionals, Wong said their main source of income is solely from their salaries as most do not have assets.

“Due to the lifestyle of KL, I don’t think they can make ends meet because the main bulk of their expenses go to car installments.

“I believe they have more than one credit card, which are liabilities, and if they have a family then they have to commit to their children’s education, health insurance and if they can afford, maybe an apartment,” he said.

He added that even earning within that range, they may be considered middle class but they will still struggle financially, with no savings at the end of the month.

He pointed out that based on statistics from Bank Negara, household debt grew close to 13 per cent annually from 2003 to 2013 but Malaysians’ income only grew about five per cent on average.

“So you can see that the growth in income cannot catch up to the growth of household debt,” he said adding that the four main liabilities for most Malaysians are home loans, car loans, credit card debts and personal loans.

Earning RM10,000

USM’s Lean said RM10,000 in an urban setting such as the Klang Valley and Penang would only provide a “standard living”, and not a luxurious one.

She said an example of a typical family with four children’s expenses include: -

House loan: RM3,000

Car loan: RM1,000

Four children: RM2,000 (RM500 each)

Utilities: RM500-RM1,000

Insurance: RM1,000

Transportation: RM1,000

Food: RM1,500-RM2,000

Total = RM10,000 to RM11,000

“Your RM10,000 is not enough to cover, definitely not entertainment, or even holidays in Malaysia.

“Gone are the days when anyone earning RM10,000 was considered rich,” she said.

Middle class group in the past

Dr Lim Teck Ghee, Centre for Policy Initiatives CEO, said rising incomes and relatively low cost of living enabled the middle class to grow in the past.

This is no longer the general rule with urban housing especially out of reach for many on lower incomes, he added.

Wong echoed the same sentiments and said the middle class group were much better off 10 years ago and beyond that.

Back then, most unmarried individuals stayed with their parents, saving on rent at a time when the cost of living was lower, he said.

“Due to the high cost of living, being middle class today doesn’t mean anything.

“It meant something 10 years ago, 20 years ago especially after the economy has been transformed from Third World to developing, we can tell because there were fewer people living in poverty in the 70s, 80s.

“But now it doesn’t mean anything,” he said.

Keep up or risk falling into poverty

Lim said the prospects of upward mobility “look dismal” for many in the middle class especially those self employed or in the informal sector.

“As the government’s record on both affordable housing and quality education has been abysmal and unlikely to improve, the middle class has to gear up for harder times ahead especially when the subsidies on essential goods, petrol, electricity and other items of everyday consumption are reduced or withdrawn,” he warned.

Moving forward, Sunway University’s Wong said the current middle class needs to consider investing their money, as well as upgrading their skills.

“Instead of working for money, they should know how to make money work for them,” he said.

“I think people have to upgrade in terms of their skills of their employment. You cannot forever be stuck at this level. You need to be more productive over time. I think productivity, talent will help you to earn more,” he added.

He also said people should also be looking for opportunities outside of Malaysia, as experience abroad would add to their bargaining power for a higher salary when they return.

The ideal middle class

“I think you need to earn close to RM10,000, of course no debts... it’s a challenge to own a house now,” Wong said.

And for those who live in urban areas, he stressed the importance of being disciplined in their spending.

He said it is important to allocate 10 to 15 per cent of one’s salary to savings and then pay the bills before spending on things which are not considered necessities.

But he acknowledged that being disciplined and not indulging in the luxuries cities like KL have to offer could be a challenge to most.

“But if you want to adopt the KL city type of lifestyle, then you can never save.”

“I think over time, again what is relevant today may not be relevant tomorrow, it doesn’t mean anything.”

“Today we see RM5,000 per month is considered middle class but RM5,000 tomorrow might go down to the bottom 40 per cent,” he said.

The trade off to having less cash, but more luxurious items

Both Wong and USM’s Lean also said the biggest difference between the middle class in the past and those in the group today, is the access to a variety of high-tech consumer products as well as niche services which did not exist 10 years ago.

“No doubt we struggle to make ends meet but we have better quality of life in terms of Internet, better coffee, so you can have these sort of counter arguments.

“Depends on what sort of things you are after,” Wong said.

https://my.news.yahoo.com/does-m ... ysia-222800802.html

Last edited by blastoff on 15-9-2014 05:57 PM

|

|

|

|

|

|

|

|

|

|

| |

|