|

View: 1828|Reply: 3

|

[Dunia]

NYSE kena hacked Anonymous?

[Copy link]

|

|

|

Did Anonymous Just Take Down the New York Stock Exchange?

Claire Bernish

July 8, 2015

(ANTIMEDIA) Shortly before midnight on Tuesday, Anonymous wished bad luck to befall Wall Street.

When the New York Stock Exchange experienced “technical issues” slightly less than twelve hours later, Anonymous appeared to have received its wish.

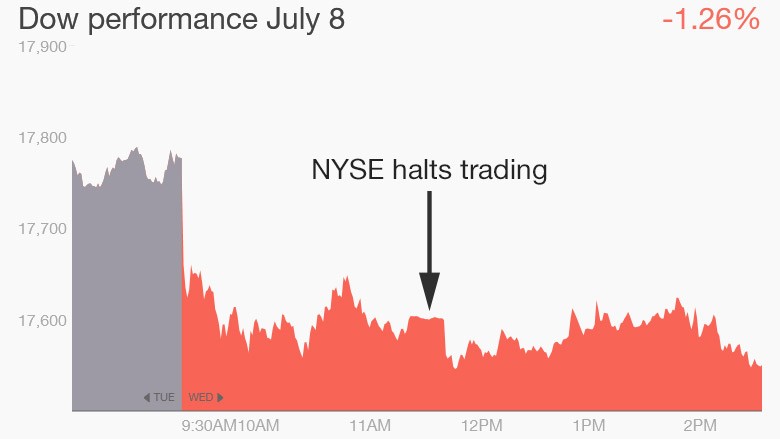

Trading abruptly halted at 11:32am on Wednesday morning due to “some technical malfunctions,” explained NYSE director of floor operations, Art Cashin. While U.S. officials claimed there were no signs of a “cyber breach” that would have caused the difficulties, the timing of the Anonymous message is . . . interesting.

Tweeted under the handle

@YourAnonNews, the midnight jinx stated, “Wonder if tomorrow is going to be bad for Wall Street . . . we can only hope.”

An unnamed Department of Homeland Security official told Bloomberg there were no indications of a cyberattack—so far. President Obama had received a briefing on the situation.

A statement posted to the NYSE Facebook page stated, “The issue we are experiencing is an internal technical issue and is not the result of a cyber breach. We chose to suspend trading on NYSE to avoid problems arising from our technical issue. NYSE-listed securities continue to trade unaffected on other market centers.”

Wednesday, itself, appeared to be the unfortunate subject of many such “technical difficulties.” In addition to the NYSE halt, New York City subway commuters experienced lengthy delays with trains inexplicably stalled in some stations. All United Airlines flights had to be grounded when the company’s computer system mysteriously malfunctioned. And 2,500 people in Washington, D.C. were left in the dark after a power outage—also unexplained.

Previous threats to the stock exchange by Anonymous in 2011 were more direct than Tuesday night’s gentle curse. One message issued a warning the collective would “destroy” the NYSE while another vowed to “erase” the NYSE from the internet altogether.

Officials are maintaining their denial of any cyber mischief—though they have not issued any plausible explanation, either—yet.

This article (Did Anonymous Just Take Down the New York Stock Exchange?) is free and open source. You have permission to republish this article under a Creative Commons license with attribution to the author and TheAntiMedia.org. Tune in! The Anti-Media radio show airs Monday through Friday @ 11pm Eastern/8pm Pacific. Help us fix our typos: edits@theantimedia.org.

http://theantimedia.org/did-anon ... ork-stock-exchange/

|

|

|

|

|

|

|

|

|

|

|

|

Trading resumes on NYSE after nearly 4-hour outage

By Patrick Gillespie, Matt Egan and Heather Long @CNNMoneyInvest

The New York Stock Exchange suspended trading at 11:32 a.m ET Wednesday and stayed down for nearly four hours.

Trading finally resumed at 3:10pm ET. It's been a rough day for stocks. The Dow shed 261 points (about 1.5%), mostly because of China's stock market plunge and ongoing fears about Greece, although the NYSE "glitch" didn't help investor confidence.

"Given the global paradigm of what's going on in the EU, Greece, China, this is the last thing that the U.S. equity markets need," said Peter Kenny, chief market strategist at the Clear Pool Group, a financial technology firm. Kenny worked on the NYSE floor for 25 years.

What happened: In a brief announcement, the exchange said it was experiencing a "internal technical issue." The NYSE said later in a tweet that it's "not the result of a cyber breach."

The Department of Homeland Security told CNN that there is "no sign of malicious activity" at the NYSE or with an earlier outage experienced by United Airlines. The FBI says it reached out to NYSE and "no further law enforcement action is needed at this time."

Other exchanges, including the Nasdaq, remained operating as usual. In other words, investors were still able to trade trade, just not on the NYSE.

"It is the most significant outage since Nasdaq's blackout [in 2013]," says Eric Scott Hunsader, a market structure expert and CEO of data company Nanex. The 2013 "Flash Freeze" caused all Nasdaq-listed shares to stop trading for more than three hours.

Wednesday's halt re-hatches the long debate on electronic trading. Some experts believe there are more negatives than positives, but the NYSE halt revealed one of the benefits of electronic trading.

"This is basically the good thing about electronic trading quite frankly -- the customer doesn't have to rely on any one venue," says Ted Weisberg, president of Seaport Securities, who has been working at the NYSE for several decades.

Other glitches: The NYSE wasn't the only one with glitches today. The Wall Street Journal's homepage stopped functioning around the same time that the NYSE went down. The Journal was able to restore its homepage by about 12:20pm.

United Airlines' computer system also malfunctioned Wednesday morning, but it was back up by the time NYSE had its big issue.

Earlier in the day Wednesday, about 200 NYSE stock symbols halted trading due to a technology glitch, including Macy's (M) and Kate Spade (KATE). Traders thought that problem had been solved, but then the whole system went down.

"They've been having problems all day. They seemed to have rectified it earlier and then it happened again. Now they shut it all down," said Joe Saluzzi, co-head of trading at Themis Trading and author of Broken Markets.

Trading is expected to resume on the New York Stock Exchange as usual on Thursday morning at 9:30 a.m.

CNN's Shimon Prokupecz and Jim Sciutto and CNNMoney's Alison Kosik contributed to this report.

CNNMoney (New York) July 8, 2015: 4:18 PM ET

http://money.cnn.com/2015/07/08/investing/nyse-suspends-trading/

ada kaitan dgn pasaran saham China TERJUN MASUK LONGKANG?  |

|

|

|

|

|

|

|

|

|

|

|

China stocks hammered as market crash continues

By Charles Riley @CRrileyCNN

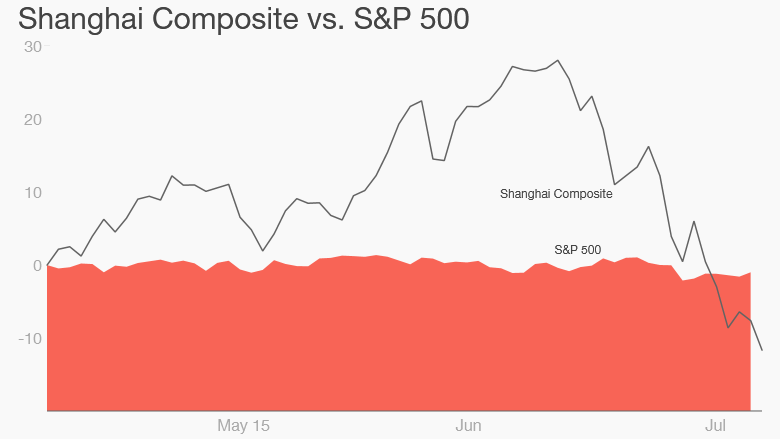

China stocks plunged again on Wednesday, even as regulators worked to contain a crisis that has wiped trillions of dollars off the country's stock markets.

The Shanghai Composite plunged 8% at the market open on Wednesday, and spent the entire day in negative territory before closing down 5.9%. The vast majority of stocks listed on the benchmark index shed 10%, the maximum limit shares are allowed to fall before being halted.

The smaller Shenzhen Composite lost 2.5%, while Hong Kong's Hang Seng dropped 5.8%.

"At the moment there is a mood of panic in the market and a large increase in irrational dumping of shares, causing a strain of liquidity in the stock market," China Securities Regulatory Commission said in statement.

Since June 12, the Shanghai Composite has lost an unnerving 32%. The Shenzhen market, which has more tech companies and is often compared to America's Nasdaq index, is down 41% over the same period.

The government is now doing everything it can to rescue the markets. The People's Bank of China has cut interest rates to a record low, brokerages have committed to buy billions worth of stocks, and regulators have announced a de-facto suspension of new IPOs.

The CSRC said Wednesday that it was actively working to relieve a liquidity crunch in the market.

But investors clearly aren't convinced by government efforts. China's stock market has been undergoing wild swings, sometimes opening with a spike of as much as 7%, before ending the day down by that much.

At least 1,430 of the 2,776 companies traded in China have elected to pull their shares as markets continue their crazy roller-coaster ride, according to state media. The number keeps ticking upward -- on Wednesday morning alone, hundreds of firms announced a halt in trading.

The most compelling theory why the stock bubble burst: Chinese economic growth is the weakest it's been since 2009. Share prices got way ahead of growth and company profits, which are actually lower than a year ago.

"China's stock market had become detached from the reality of China's own economy, and appallingly overvalued," Patrick Chovanec, managing director at Silvercrest Asset Management, said on Twitter. "This is gravity taking effect."

According to Bespoke Investment Group, China's stock markets have now lost $3.25 trillion. To put that in perspective, that's more than the size of France's entire stock market and about 60% of Japan's market.

While the volatility is a major issue in China, few foreign investors have much exposure to these stock markets. The real concern for those outside China is an economic slowdown and wider impact from a fluctuating stock market, rather than the market swings themselves.

http://money.cnn.com/2015/07/07/ ... html?iid=TL_Popular

|

|

|

|

|

|

|

|

|

|

|

|

Aku bukan paham sgt se dgn ekonomi2 ni

Yg aku tau bagi balik la duit yg dah disonglap tu deyyy  |

|

|

|

|

|

|

|

|

|

| |

|